With Wells Fargo Online Banking access your checking savings and other accounts pay bills. A government-issued photo ID like a drivers license state-issued ID or passport. Please refer to our fees page for fees associated with our online services. Checking and savings accounts and credit cards for your everyday business expenses and cash management. Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®.

Available to almost anyone with a U.S.-based bank account. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®.

Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement.

Transactions between enrolled users typically occur in minutes. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Cross-selling, the practice underpinning the fraud, is the concept of attempting to sell multiple products to consumers.

For instance, a customer with a checking account might be encouraged to take out a mortgage, or set up credit card or online banking account. Success by retail banks was measured in part by the average number of products held by a customer, and Wells Fargo was long considered the most successful cross-seller. Richard Kovacevich, the former CEO of Norwest Corporation and, later, Wells Fargo, allegedly invented the strategy while at Norwest. Under Kovacevich, Norwest encouraged branch employees to sell at least eight products, in an initiative known as "Going for Gr-Eight". Deposit products offered by Wells Fargo Bank NA. Get Mobile Banking Bill Pay and access to ATMs. With online banking through Wells Fargo Online you can monitor your balances and activity set up alerts and view statements all from your smartphone tablet or desktop.

To open a checking account or any other type of account youll also need the following. You can access almost all banking facilities from Well Fargo Online Banking login page. You Can Easily Manage Your Account With Wells Fargo Online Banking Login Page. Charges may apply however for the Wells Fargo Same Day Payments Service SM. Wells Fargo Online Login here for secure access. Other software companies realized that there was potential to become the platform of choice for customers to do their banking. Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems.

Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time. They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature. Customers had to buy a software package and pay a monthly fee for their software's subscription in addition to any fees charged by their bank. Customers had to use floppy disks and dial up modems to connect to their information. Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service. Wells Fargo internet banking services enable customers manage their bank accounts and find ATMs and bank locations in the state.

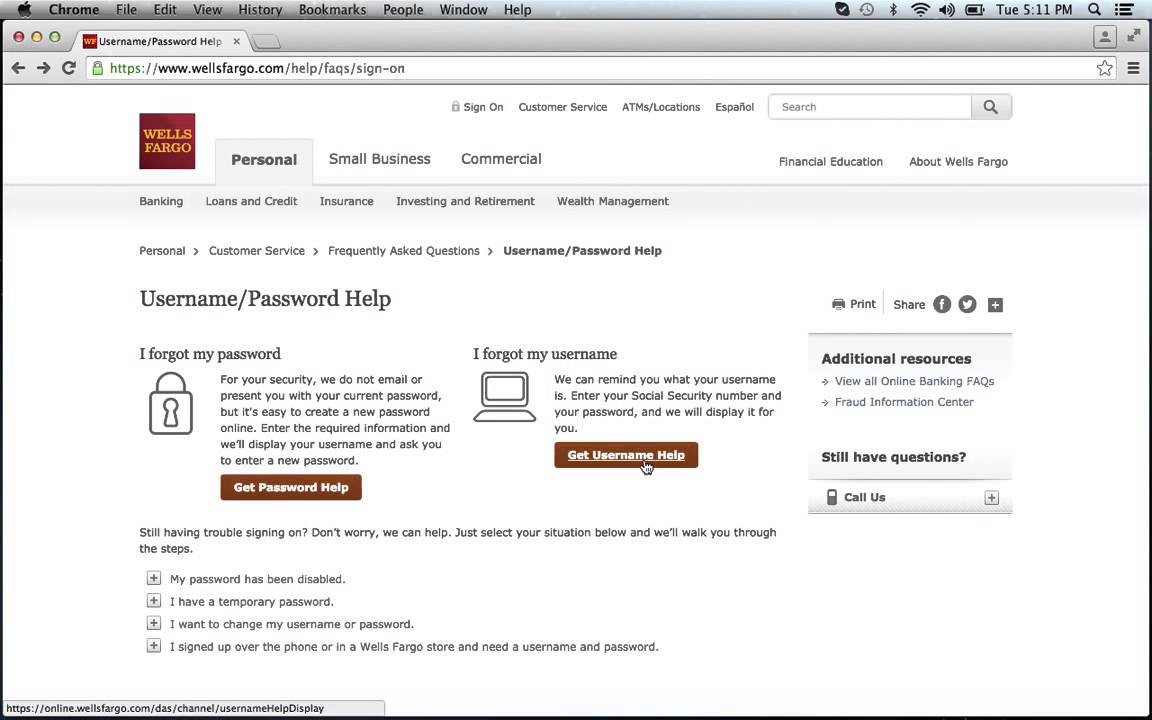

It's free to set up an online account with the bank provided you are a customer with a bank account. The internet banking services are available for both individual and business banking. In this post, you will learn how to login into your online account, how to change your password and how to register for the online services. Customers can use a debit card with contactless and chip technology instead, pay bills online, and make digital payments. Mobile deposit is only available through the Wells Fargo Mobile app. $5 monthly service fee is waived for primary account owners 13 to 24 years old, although teens 13 to 16 need an adult co-owner.

All of the accounts included on this list are FDIC-insured up to $250,000. Note that the interest rates and fee structures for brick-and-mortar savings accounts are subject to change without notice. Product and feature availability vary by market so they may not be offered depending on where you live. Most brick-and-mortar banks require you to enter your zip code online for the correct account offerings.

Any return on your savings depends on the associated fees and the balance you have in your brick-and-mortar savings account. To open a savings account, most banks and institutions require a deposit of new money, meaning you can't transfer money you already had in an account at that bank. We also considered factors such as insurance policies, users' deposit options, other savings accounts being offered by the same bank and customer reviews when available. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account.

Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account.

Availability may be affected by your mobile carrier's coverage area. Wells Fargo Business Online® banking provides a consolidated picture of your checking and savings accounts, credit cards, lines of credit, and loans. Monitor account activity, access over 18 months of transaction history, pay business bills, make transfers and more all from one secure online location. This account allows customers to earn interest on their checking balances over $500.

The account owners can order cashier's checks from the bank without any additional fees. Since the typical fee is up to $10, those using cashier's checks often can save significantly. If you prefer personal checks, you'll also get a $10 discount. We recommend you select a unique username and password and memorize it rather than writing it down. The other Wells Fargo savings account is Platinum Savings.

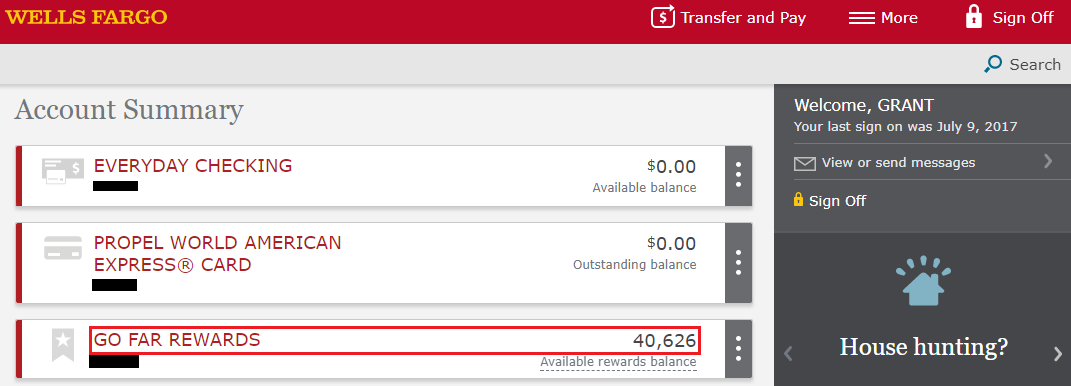

This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period. Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts. Once you have your Wells Fargo Business Online banking password and username, choose whether you want to view all your business and personal accounts together or separately.

Assign view-only account access for up to 25 guest users, such as key employees or a bookkeeper. Sign up for alerts to help track account balances, debit card transactions, credit limits, and more. Еhe premium service for eligible customers offers bonus interest rates as well as zero-commission at external ATMs .

The account owners get interest on their account balance, earn rewards, receive loan discounts, and are served by the Premier support team. No fees incurred for Wells Fargo Personal Wallet checks, cashier's checks, and money orders. The monthly $30 fee is waived for those having $25,000 or more in qualifying linked bank deposits, or over $50,000 in qualifying linked bank, brokerage, and credit balances. Premium clients also get an annual Relationship bonus on the non-bonus rewards points they earn with the Wells Fargo Propel World American Express Card. Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply.

Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app. To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone.

For more information, view the Wells Fargo Wire Transfers Terms and Conditions. Wells Fargo offers to check and savings account options to both resident and non-resident foreigners. The accounts can usually be linked to a debit card or an ATM card – giving you quick access to cash – and can be managed online, as well as at ATMs. However, those who reside within the US have the advantage of opening their accounts online, which is a great benefit while pandemic health concerns still occur. Non-residents would have to visit one of the bank's numerous branches in person. Wells Fargo Everyday Checking is Wells Fargo's most popular account for day-to-day banking.

Employees also created fraudulent checking and savings accounts, a process that sometimes involved the movement of money out of legitimate accounts. The creation of these additional products was made possible in part through a process known as "pinning". By setting the client's PIN to "0000", bankers were able to control client accounts and were able to enroll them in programs such as online banking. Gives customers unlimited branch and ATM withdrawals and the option to write checks. Optional overdraft protection for your checking account is another benefit.

The account is better suited to those having higher savings goals. Thus, the monthly service fee of $12 is waived when you maintain a $3,500 minimum daily balance each fee period. To open a checking account online, you'll have to indicate a zip code for the US city of your residence. That is necessary to show you appropriate offers and prices. You also have the opportunity to open both an individual and joint bank account, so you have to choose a suitable variant. With a joint account, you and your partner can pay shared household expenses, such as a mortgage, car payments, utilities, and groceries, from the same place.

Moreover, joint account funding may help you meet the minimum balance requirements that qualify you for features like waived maintenance fees, a higher interest rate, or additional rewards. There could be many reasons why you want to close your bank account. It's not uncommon for traditional banks to offer free checking accounts only for you to be slammed with hidden fees later on. Or for banks to promise high yields on investments and savings accounts, but then you realize the high fees that come with the high yield don't really make it worth it. On the other hand, some banks just make it outright difficult for immigrants.

Now you've found a better banking solution and want to get rid of the hassle. The account comes with access to Wells Fargo Mobile app, a debit card with chip technology, budgeting, cash flow and spending tools, online bill pay and 24/7 customer service. Account holders also have access to the Zelle peer-to-peer payment platform.

Mobile deposit is only available through the Wells Fargo Mobile® app. See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations. There are multiple ways to waive the $10 monthly service fee. The overdraft fee is $35, but you can link to a Wells Fargo savings account for overdraft protection.

You'll still pay $12.50 for transferring funds as overdraft protection, though, so this account is probably the best fit for people who don't expect to overdraw at all. Though it's a savings account, you have the ability to write checks from this account as long as you have the sufficient funds in the account. You can also link this account to a regular Wells Fargo checking account for overdraft protection. Wells Fargo offers several other products and services outside of its personal deposit accounts. The bank offers many credit cards, including several popular rewards and cash back credit cards.

Verschoor explains the findings of the Wells Fargo investigation shows employees also opened online banking services and ordered debit cards without customer consent. Only select Apple devices are eligible to enable Face ID®. If you have family members who look like you, we recommend using your username and password instead of Face ID® to sign on. When it comes to determining what accounts will work for you, review your needs. Do you need a way to set money aside for longer-term savings goals? Also, consider the proximity and availability of your bank's ATMs and branches, in addition to other personal preferences that may be important to you like online banking and overdraft protection.

Provides a variety of automatic savings options if it's linked to a Wells Fargo checking account. Teens and students under 24 are exempt from the $5 monthly fee. Even if you're older, you can use the account for free by fulfilling minimum automatic deposit requirements. The most popular Wells Fargo checking account has custom text and email alerts to monitor account activities. It's supplemented by a Platinum debit card with chip technology. Unlike Clear Access Banking, this account has a check-writing option.

It also brings additional benefits to students if Wells Fargo Campus ATM or Campus Debit Card is linked. The fee is waived if the owner has a $500 minimum daily balance or $500 and more in total qualifying direct deposits. You can also enjoy a zero service fee if you are 17 through 24 years old or have a linked Wells Fargo Campus Card. Each withdrawal over the six-per-month limit will be assessed and may come with a fee. Those who link a Wells Fargo checking account can opt for overdraft protection. Opting in is free to do, but a single transfer fee will be assessed if the bank ends up transferring funds to cover your transactions.

If you take the time to waive the paper statement fees by switching to online statements, Wells Fargo's monthly fees are slightly better than those at other major banks. However, the real advantage at this bank comes with the large variety of options. The Wells Fargo Opportunity Checking Account gives such "toxic" bank customers an opportunity to get back into the mainstream banking system. Only select Android devices are eligible to enable Biometric Sign-On . If you have family members who look like you, we recommend using your username and password instead of Biometric Sign-On to sign on. Overdraft Protection is an optional service you can add to your checking account by linking up to two eligible accounts .

We will use available funds in your linked account to authorize or pay your transactions if you don't have enough money in your checking account. The service is subject to applicable transfer and advance fees. Overdraft Protection is not available for Clear Access Banking℠ accounts.

For more information, please refer to the Deposit Account Agreement and Fee and Information Schedule applicable to your account, or visit wellsfargo.com/overdraftservices. Wells Fargo Online comes with the ability to receive and view statements for most of your accounts online. Simply enroll to set up a username and password to access your personal and business accounts online. Wells Fargo does not charge a fee to send or receive money with Zelle. However, when using Zelle on a mobile device, your mobile carrier's message and data rates may apply.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.